Services

Medicare Advantage Plans – Medicare Part C – Medicare Health Plans

Medicare Advantage Plans – Medicare Part C – Medicare Health Plans

Medicare Advantage Plans are health plan options that are part of the Medicare program, Medicare Advantage can also be referred to as Medicare Part C. If you join one of these plans, you generally get all your Medicare-covered health care through that plan. This coverage can include prescription drug coverage. Medicare Advantage Plans include:

- Medicare Health Maintenance Organization (HMOs)

- Preferred Provider Organizations (PPO)

- Private Fee-for-Service Plans

- Medicare Special Needs Plans

When you join a Medicare Advantage Plan, you use the health insurance card that you get from the plan for your health care. In most of these plans, generally there are extra benefits and lower copayments than in the Original Medicare Plan. However, you may have to see doctors that belong to the plan or go to certain hospitals to get services.

To join a Medicare Advantage Plan, you must have Medicare Part A and Part B. You will have to pay your monthly Medicare Part B premium to Medicare. In addition, you might have to pay a monthly premium to your Medicare Advantage Plan for the extra benefits that they offer.

Understand the differences between your Medicare Advantage coverage and a Medigap Insurance Plan is very important. With a Medicare Advantage Plan there are a lot more rules and regulations you must follow compared to having a Medigap Insurance Plan, such as having to use specific doctors or hospitals on some plans, understanding that if you move away from the county you live in to another county that your current plan is not offered in will me that you will automatically loose that coverage, also knowing that you are locked into a Medicare Advantage Plan for a years time if you do not decide with in a few months of accepting that coverage to change or drop it.

With the different choices and options that are available to you as a Medicare Beneficiary when it come to covering the gaps left by just having Medicare alone, it is strongly suggested that you have a licensed, independent insurance agent on your side. Here at Medigap Select of Texas, we can be that agent that you can have a long lasting relationship with to help you understand and find the best Medicare insurance options available for you. Give us a call today, or please fill out our safe and secure, no-obligation Medicare Supplement Quote Form to have an agent contact you and help in making sure that you are covered in the right way.

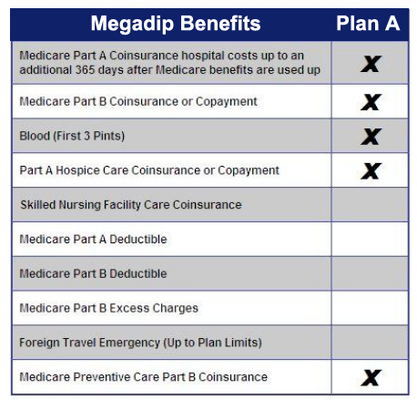

Plan A

Medigap insurance Plan A is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan A quote.

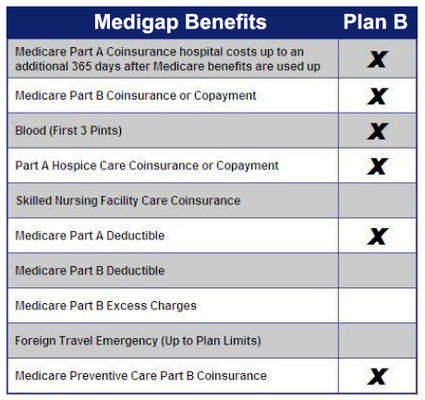

Plan B

Medigap insurance Plan B is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find for your Medicare Supplement Plan B quote.

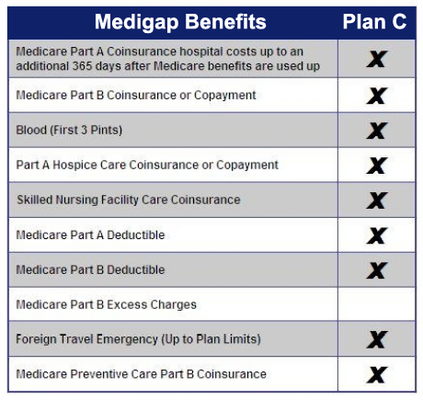

Plan C

Medigap insurance Plan C is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find for your Medicare Supplement Plan C quote.

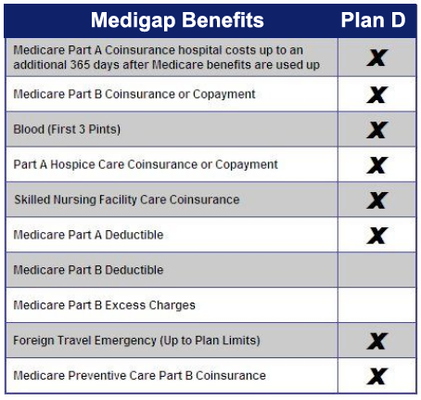

Plan D

Medigap insurance Plan D is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find for your Medicare Supplement Plan D quote.

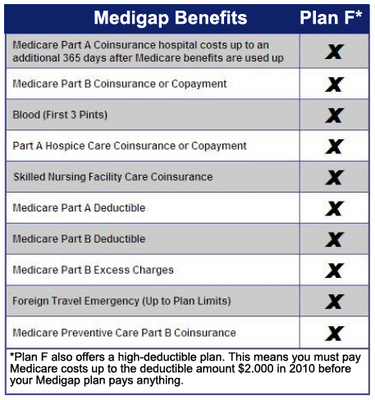

Plan F

Medigap insurance Plan F is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan F quote.

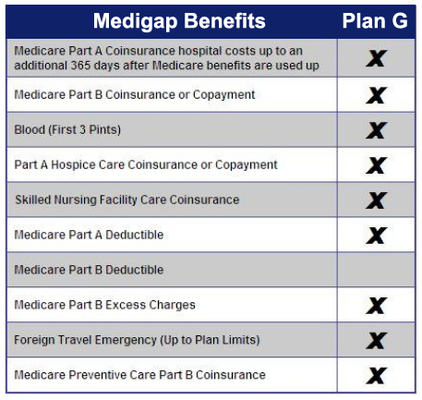

Plan G

Medigap insurance Plan G is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan G quote.

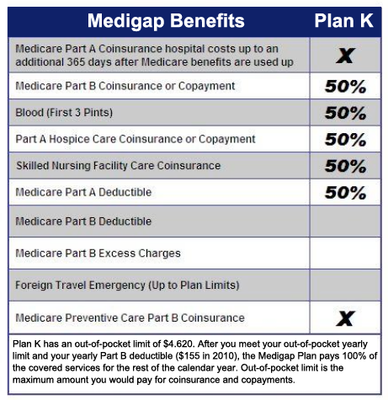

Plan K

Medigap insurance Plan K is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan K quote.

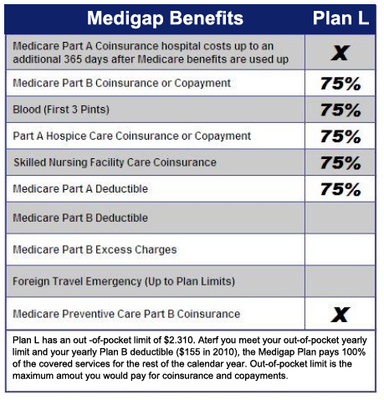

Plan L

Medigap insurance Plan L is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan L quote.

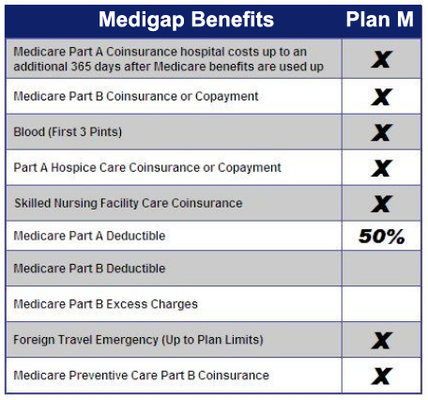

Plan M

Medigap insurance Plan M is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan M quote.

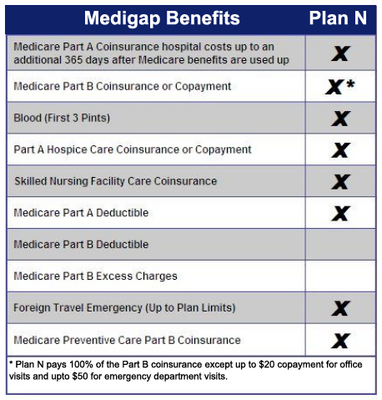

Plan N

Medigap insurance Plan N is one of 10 different plans currently offered by insurance companies to cover gaps left in your Medicare Parts A and B. Each Medigap Plan offers a different array of coverage options. Here at Senior Benefits Expert, our agents will walk you through the benefits of each plan and make sure that you find the Medicare supplement coverage that best meets your needs. Contact an agent today to find your Medicare Supplement Plan N quote.

New to Medicare – Turning 65

Did you just turn 65, or are you about to? Are you new to Medicare and trying to understand your options? Entering in to Medicare can be a very confusing and daunting task if you do not have some on your side that can help. Do you have the right Medicare Parts (A, B, C, and/or D)? Which Medigap Insurance Plan is the best for me (Plans A, B, C, D, F, G, K, L, M, or N)? What is the difference between a Medigap Insurance Plan and a Medicare Advantage Plan? This is where Senior Benefits Expert can help by having an agent on your side to help you understand the rules and best possible routes to go when making sure that you are covered the right way with Medicare.

Helpful points to keep in mind when buying Medigap Insurance

- Purchase a Medigap Plan during your Open Enrollment. The best time to purchase a Medigap policy is during your Medicare Open Enrollment period (age 64 1/2 to age 65 1/2) or the Guaranteed Issue Period. By doing this, companies cannot refuse you coverage because of pre-existing conditons.

- Use an independent agent that has an insurance portfolio of more than just a few policies. True independent agents or agencies will make sure to offer their clients many choices that are available, and do side by side comparisons of price and benefits. Even though all Medigap insurance plans are standardized, prices for the same plan can vary between insurance companies.

- Financial Stability – When choosing a Medicare supplement insurance company, always look in to the financial stability, as well as the number of complaints of the insurance company. Always ask or do research on the A.M. Best Financial rating and other rating companies. You can usually get this information from your state department of insurance.

During your Open Enrollment Period or Guaranteed Issues Period, which by definition is 6 months before and after your effective date of you Medicare Part B, an insurance company is not allowed to medically underwrite your policy. This means the insurance company cannot do any of the following:

- Refuse to sell you any Medigap policy it has available

- Make you wait for your coverage to start

- Charge you more for a Medigap policy because of any health conditions

The insurance companies cannot make you wait for your coverage to begin, but they may be able to make you wait for coverage of a pre-existing condition. A pre-existing condition is a health condition you have before your Medigap insurance policy starts. In certain cases, the insurance company can refuse to cover your out-of-pocket costs for these pre-existing health problems for up to 6 months. This is called a “pre-existing condition waiting period.” Coverage for a pre-existing condition can be excluded from your Medigap policy if the condition was treated or diagnosed within 6 months before your new Medigap policy begins.

What Is Medicare Part D and How Does It Work?

Medicare Part D, also known as the prescription portion of the Parts of Medicare, is a part of the Medicare Modernization Act signed into law in 2003. Beginning 2006 Medicare Part D, a prescription drug benefit was made available to individuals and offered through private insurance companies and HMO’s. Part D is voluntary, but comes with a penalty if not purchased.

What is Medicare Part D?

Medicare Part D is the outpatient prescription drug portion of Medicare. Benefits are provided through private insurance companies approved by Medicare and have different levels of plans to choose from. The different choices included in the different plans available are, but are not limited to, different monthly cost, deductible options, different co-pays, different tier options, some plans even offer better out-of-pocket cost if you use a preferred pharmacy. Ultimately, it all depends upon the medication you personally take when choosing the right prescription coverage to meet your needs.

How Do You Get Medicare Part D Coverage?

If you are entitled to Medicare, to obtain a Part D prescription drug plan, you have two options on how to receive this coverage. Your first option would be, if you elect to stay with Original Medicare, you can apply for a standalone Part D plan. In most cases this will allow you to pick and choose from roughly 25-35 different Part D plans in your area. The other option is if you choose to receive your Medicare health insurance benefits through a Medicare Advantage Plan (Medicare Part C), most of these plans will automatically have Part D prescription coverage built into it. Just note that you have to follow the plans specific formulary. So, make sure to check your medications to make sure they are covered. On the other hand, some Medicare Advantage Plans (PFFS or Private Fee For Service) will allow you to only choose the health portion of the coverage and allow you to choose a standalone Part D Plan.

How Do I Pick the Right Medicare Part D Plan?

Simply stated, it is all about the medications you take. Even though each Medicare Part D Plan available must follow the law of Part D, they differ in the since of cost, if it has a deductible, their formulary list, and which pharmacy may be in network or considered preferred.

This means that without help you could be overpaying for your Part D Plan and the overall cost of your medications. This is where enlisting the services of an independent agent can be advantageous. If an independent agent has access to all of the information on all of the plans in your area, they can help narrow down the best plan to meet your needs. You can also go to www.Medicare.gov, they offer the best software, in my opinion, that will allow you to enter in you zip code and the medication you take and they will filter all the Part D Plans available in your area and filter them for the “Best Annual Retail Drug Cost”. This will ensure that you do not overpay for your coverage and that all of your medications are covered.

2014 Medicare Deductible and Coinsurance Changes

This upcoming year is bringing changes again to Medicare’s Deductible and Coinsurance. Here at Senior Benefits Expert we want to make sure that you are aware of the changes and are kept update with how Medicare’s Part A and B coverage works for you. Also, keep in mind that if you are covered by a Medicare supplement insurance plan or anywhere else in the United States, that all Plans are standardized for your protection and are ment to match the federal program’s deductible and coinsurance increases. For more information on Medigap Insurance Policies and how they coinside with the below mentioned changes to Part A and B, please contact an agent at 443-221-0246.

| Medicare Benefits |

2013 |

2014 |

| Part A Inpatient Hospital Deductible |

$1,184 |

$1,216 |

| Hospital Coinsurance 61 – 90 days 91 – 150 days (Lifetime Reserve) |

$296 |

$304 |

| Skilled Nursing Facility Care Coinsurance 21 – 100 days |

$148 |

$152 |

| Part B Physician’s Service and Supplies Deductible |

$147 |

$147 |

Please not that the chart above only represents what changes will be occuring from the 2013 calander year to the 2014 calander year, this chart does not represent the full coverage benefits from having Medicare’s Part A and B.

The standard Medicare Part B monthly premium will be $104.90 in 2013, this amount won’t change in 2014. To find out more about your Medicare Part B premium, please contact the Social Security Administration at 1-800-772-1213 or visit them at www.ssa.gov.

Higher-income beneficiaries pay $104.90 plus an additional amount, based on the income-related monthly adjustment amount (IRMAA).

Part A costs

How much does Part A cost?

You usually don’t pay a monthly premium for Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes while working. This is sometimes called “premium-free Part A.”

If you buy Part A, you’ll pay up to $426 each month.

But, most people get premium-free Part A. You can get premium-free Part A at 65 if:

- You already get retirement benefits from Social Security or the Railroad Retirement Board.

- You’re eligible to get Social Security or Railroad benefits but haven’t filed for them yet.

- You or your spouse had Medicare-covered government employment.

If you’re under 65, you can get premium-free Part A if:

- You got Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have End-Stage Renal Disease (ESRD) and meet certain requirements.

In most cases, if you choose to buy Part A, you must also have Medicare Part B (Medical Insurance) and pay monthly premiums for both.

Some people automatically get Medicare Part A (Hospital Insurance). Learn how and when you can sign up for Part A.

Contact Social Security for more information about the Part A premium.

Part B costs

You pay a premium each month for Medicare Part B (Medical Insurance). Most people will pay the standard premium amount. However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much does Part B cost?

Most people pay the Part B premium of $104.90 each month.

You pay $147 per year for your Part B deductible.

Some people automatically get Part B. Learn how and when you can sign up for Part B.

If you don’t sign up for Part B when you’re first eligible, you may have to pay a late enrollment penalty.

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount, you may pay more.

Social Security will contact some people who have to pay more depending on their income. The amount you pay can change each year depending on your income. If you have to pay a higher amount for your Part B premium and you disagree (for example, if your income goes down), use this form to contact Social Security.

Part B premiums by income

| If your yearly income in 2012 (for what you pay in 2014) was | You pay (in 2014) | ||

|---|---|---|---|

| File individual tax return | File joint tax return | File married & separate tax return | |

| $85,000 or less | $170,000 or less | $85,000 or less | $104.90 |

| above $85,000 up to $107,000 | above $170,000 up to $214,000 | Not applicable | $146.90 |

| above $107,000 up to $160,000 | above $214,000 up to $320,000 | Not applicable | $209.80 |

| above $160,000 up to $214,000 | above $320,000 up to $428,000 | above $85,000 and up to $129,000 | $272.70 |

| above $214,000 | above $428,000 | above $129,000 | $335.70 |

Get more information about your Part B premium from Social Security.

In 2014, there may be limits on physical therapy, occupational therapy, and speech language pathology services. If so, there may be exceptions to these limits.

Senior Benefits Expert Medicare Supplements | Medigap Insurance Plans

When searching for Medicare Supplement Plans , your search can be as broad as the State itself. Your have many choices in insurance companies that offer Medicare Supplement Insurance Plans, but this is where Senior Benefits Expert can help.

Being an independent health and life insurance agency that specializes in Medicare supplements, allows us to shop and compare different Medigap insurance plans to help find you an affordable insurance option for you Medicare supplemental coverage. We offer side-by-side comparisons and free, no-obligation Medicare reviews to help you get all the right information to make an informed decision.

Medicare and its insurance options can be quite confusing and overwhelming to individuals that are new to Medicare, just turning 65, or someone not keeping up-to-date with any changes to the Medicare program. Having a personal agent on your side is the best option for you to make sure that you are always protected the way to meet your specific needs. No matter if you have questions on Medigap Insurance Plans, Medicare Advantage Plans, or Medicare’s Part D prescription coverage, we can help walk you through all the ins and outs.

Here is a helpful hint to help you in your search for Medicare supplement insurance, or in any other state in the U.S. In the publication,”Choosing a Medigap Policy 2014,” published by the Centers of Medicare and Medicaid Services, you will find the following statement on page 9:

“Every Medigap policy must follow Federal and state laws designed to protect you, and the policy must be clearly identified as “Medicare Supplement Insurance.” Medigap insurance companies in most states can only sell you a “standardized” Medigap policy identified by letters A through N. Each standardized Medigap policy must offer the same basic benefits, no matter which insurance company sells it. Cost is usually the only difference between Medigap policies with the same letter sold by different insurance companies.”

This statement holds true in your state. Not to say that the cheapest plan is always offered by the highest rated Medicare supplement insurance company, but always keep that statement in mind when comparing premium cost of each Medicare supplement plan, and please let Senior Benefits Expert be there to help walk you through the process. Feel free to contact an agent today at 443-221-0246.

With so many options for Medicare supplements, just like in any other state. Here at Senior Benefits Expert we are known as one of the premier agencies for Medicare.

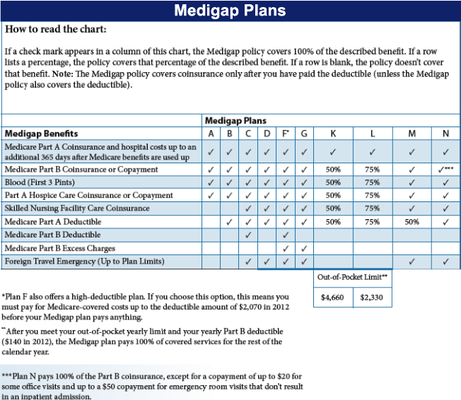

Medigap Insurance Plans

Federal and state laws regulate Medigap policies. These laws are put in place to protect you as a beneficiary. Medigap policies have to be clearly labeled as “Medicare Supplement Insurance.” In some states, as of June 1, 2010, you may be able to choose from up to 10 different standardized policies (Medigap Plans A, B, C, D, F, G, K, L, M, and N).

Each Medicare supplement insurance plan offers a different set of basic benefits and is the same for every insurance company. Because benefits are the same for every insurance company, you do not want to overpay. Insurance companies set their own prices and decide which policies they want to sell.

Medigap policies no longer cover prescription drugs. If you have a Medicare Prescription Drug Plan (Part D) and a Medigap policy that covers drugs, then you need to tell your Medigap insurance provider to remove the drug coverage from your policy. You may choose to keep the Medigap policy with prescription drug coverage; however, you cannot have both.

Medigap Insurance Plans A, B, C, D, F, and G

Plans A, B, C, D, F, and G have more benefits, higher premiums, and lower out-of-pocket expenses. Basic benefits include Medicare Part A and B co-pay or co-insurance, and three pints of blood. Benefits include Skilled Nursing Facility co-insurance, Medicare Part A and B deductibles, Medicare Part B excess charges, foreign travel emergency services, and preventive care.

Medigap Insurance Plans K and L

Plans K through L have lower premiums and higher out-of-pocket expenses. Basic benefits include Medicare Part A hospital benefits, Medical Part A and B co-insurance or co-pay, blood, and hospice care. Benefits include Skilled Nursing Facility co-insurance and Medicare Part A deductibles.

Medigap Insurance Plans M and N

Plans M and N feature Higher cost sharing and lower anticipated premiums for policyholders. Plan M – has increased cost-sharing (50% of the Part A Deductible, no coverage for Part B Deductible). Plan N – has a new co-pay structure ($20 co-pay for physician visits, $50 co-pay for ER) and no coverage for Part B Deductible.

Remember, when choosing a Medigap plan, compare each plan and then compare different insurer quotes. You want to make sure you have adequate coverage to meet your needs, but you don’t want to pay more when each plan is the same for every insurance company.

Did you know that Original Medicare does not cover Routine Dental Care?

For most Seniors that age in to Medicare and start receiving insurance benefits from Medicare Part A and B, many our shocked to know that Routine Dental Care is not covered. Even having a Medicare Supplement or Medigap insurance Plan will not help cover your dental needs. Some Medicare Advantage Plans offer dental insurance benefits, but making sure you are covered with the right insurance plan is vital.

Here at Senior Benefits Expert we offer and support __________ Dental as our number one choice for Senior Dental Plans.. Since ______, ________ has successfully implemented a number of strategic alliances, special marketing arrangements and dental block acquisitions. We believe in delivering quality results with impeccable customer service, while ensuring a seamless transition for everyone.

At __________, they put their customers first. And second. And third. Always. That’s why they’re able to provide over 4.8 million people with quality dental, eye care and hearing care plans that fit their specific needs. And why they’re ready and able to provide millions more with the same impeccable service.

_________ offers “My Dental Plan”. To view the brochure and benefits of this plan, CLICK HERE.

It’s easier to get the care you need when you have a plan to help cover the cost. My Dental Plan helps individuals and families keep their smiles healthy. Three plan choices let you purchase the level of coverage that’s right for your needs and budget.

- Continuation of Benefits (No-Waiting Periods) for individuals that have coverage now or that have not let there past coverage lapse for more than 30 days.

- All plans pay a benefit, after the $50 per-person deductible, toward essential care such as an annual exam and cleaning, fillings, X-rays, simple extractions, and fluoride and sealants under age 14.

- You can choose a plan that helps cover expenses for a second exam and cleaning each year, plus Major care such as root canals, space maintainers, surgical endodontics, periodontal procedures, crowns, surgical extractions and general anesthesia.

- Annual maximum benefits available are $500, $1,000 or $1,500. Plus our Dental Rewards? feature lets qualifying individuals who meet plan requirements earn an additional amount to add to their following year’s annual maximum.

- One of our plans includes a $100 eye care benefit to use for eye exams, frames, lenses or contact lenses from the eye doctor of your choice, plus provides access to discounts on eye exams and products.

-

All plans let you and your covered dependents (even your pets) save on prescription medications through any Walmart or Sam’s Club pharmacy across the nation. This Rx discount, which is not insurance, is offered at no additional cost.

Trying to Understanding Medicare?

Since Medicare was signed into law in 1965, there have been numerous changes to the plan. Medicare now has four different parts titled Part A, Part B, Part C and Part D. To many seniors and their families it can be quite a process to try and understand each Part, how they work, and if/what coverage is actually needed. No worries, here at Senior Benefits Expert, this is what we do… we take the confusion out of Medicare to help you understand and find the right coverage for you.

Part A covers the details of expenses associated with hospitalization and its costs are paid by “FICA” taxes collected throughout your working career. Part B deals with services provided at outpatient clinics and physician’s offices. Seniors must first enroll in Part B to take advantage of the program, and there is a monthly fee for the benefits. Part C, also referred to as Medicare Advantage, is a separate choice for seniors other than a Medigap insurance plan. Part D is the newest letter to the Medicare law and it deals primarily with providing prescription coverage for seniors.

Most seniors who are enrolled in Medicare will want to also purchase a Medicare supplement insurance plan. Insurance companies add to the Medicare alphabet by labeling the supplements Plans A through N. Just remember these are Plans to supplement Medicare, not Parts of Medicare. Each Medicare supplement plan comes with different levels of benefits and different premiums. At Senior Benefits Expert, we want to make sure that our seniors get the Medicare coverage they need at the price they can afford. Our agents will help explain what your potential out-of- pocket expenses will be with each plan. We offer products from the top-rated insurance companies, so we are able to find the quality plan that will work for your health and your pocketbook. Feel free to contact an agent today at 443-221-0246 or complete our Senior Benefits Expert Medicare Supplement Quote Form to receive rates from insurance carriers in your area.

High Deductible Plan F Medicare Supplement Insurance Plans

Most people are unaware that there is even such a plan as a High Deductible Plan F Medicare supplement. I wish there was a nice chart or visual to show you about a HD Plan F, but it covers exactly like a regular Plan F Medicare supplement insurance plan… with one catch – you have to meet a $2,140 deductible before the plan covers at 100%.

Now, to slow down a little bit and explain the plan a little more in detail. I would first like to remind everyone that a when you have a Medicare supplement insurance plan, Medicare is the primary insurance. I bring this up due to the fact that when most people hear the word deductible, they think they have to meet that before they receive any benefits. This is not true in the case of a HD Plan F. Medicare is going to pay what it is scheduled to pay.

Medicare Part A (Hospital Services) has an $1,216 deductible for 2014 per benefit period that must be met when you enter into a hospital setting. On a High Deductible Plan F, if you have not met your deductible, you will responsible for this amount. The nice thing is that amount is then applied towards your overall out-of-pocket deductible of $2,140 for 2014.

Medicare Part B (Medical Services – Outpatient) has an annual deductible of $147 for 2014 and then Medicare pays 80% of their approved charges, you are responsible for 20% and any excess charges. Again, the nice thing about a High Deductible Plan F is it brings in a cap that Original Medicare does not have – the $2,140 annual deductible.

If and when the deductible is ever met on a HD Plan F Medigap Plan, your plan then covers exactly like a regular Medigap Plan F.

What are the advantages to a High Deductible Plan F Medicare supplement insurance plan ?

- Just like any other Medicare supplement plans, you are not restricted to doctors and hospital in-network (like on a Medicare Advantage Plan). You have the freedom of choice to choose any doctor or hospital, throughout the U.S. that accepts Medicare.

- Lower monthly premiums then other Medigap Insurance Plans.

- Adds a maximum out-of-pocket to the cost that you could be subject to by just having Original Medicare.

- In most cases the out-of-pocket or $2,140 deductible is less of a calendar year risk than most Medicare Advantage Plans that can range from $3,400 to $7,500.

If you would like to receive more information on High Deductible Plan F Medicare supplements , please contact an agent today at 443-221-0246.

Medigap Policies For People Under Age 65 With A Disability

or End-Stage Renal Disease (ESRD)

You may have Medicare before age 65 due to the following:

- A disability, or

- ESRD (permanent kidney failure requiring dialysis or a kidney transplant).

If you are under age 65 and disabled or have ESRD, you may not be able to buy the Medigap policy you want until you turn 65. Federal law doesn’t require insurance companies to sell Medigap policies to people under age 65. However, some states require insurance companies to sell you a policy, at certain times, even if you are under age 65.

During the first six months after you turn age 65 and are enrolled in Medicare Part B, you will get a Medigap open enrollment period. It doesn’t matter that you have had Medicare Part B before you turned age 65. During this time:

- You can buy any Medigap policy, and

- Insurance companies cannot refuse to sell you a Medigap policy due to a disability or other health problem, or charge you a higher premium than they charge other people who are 65 years old.

When you buy a policy during your Medigap open enrollment period, the insurance company must shorten the waiting period for pre-existing conditions by the amount of creditable coverage you have. If you had Medicare for more than six months before you turned 65 years old, you won’t have a pre-existing condition waiting period because Medicare counts as creditable coverage.

Several states require Medigap insurance companies to offer a limited Medigap open enrollment period for people with Medicare Part B who are under age 65. The following states (Licensed States that Senior Benefits Expert practice in) require insurance companies to offer at least one kind of Medigap policy during a special open enrollment period to people with Medicare under age 65:

| California | Connecticut | Kansas |

| Louisiana | Maine | Maryland |

| Massachusetts | Michigan | Minnesota |

| Missouri | Mississippi | New Hampshire |

| New Jersey | New York | North Carolina |

| Oklahoma | Oregon | Pennsylvania |

| South Dakota | Texas | Washington |

|

Wisconsin |

||

Also, some insurance companies will sell Medigap policies to people with Medicare under age 65. However, these policies may cost you more. Remember, if you live in a state that has a Medigap open enrollment period for people under age 65, you will still get another Medigap open enrollment period when you turn age 65.

Also, if you join a Medicare Advantage Plan (formerly Medicare + Choice) and your coverage ends, you may have the right to buy a Medigap policy. If you have questions, you should call your State Health Insurance Assistance Program.

Right to suspend a Medigap policy for disabled people with Medicare

If you are under 65, have Medicare, and have a Medigap policy, you have a right to suspend your Medigap policy. You can suspend your Medigap policy benefits and premiums, without penalty, while you are enrolled in your or your spouse’s employer group health plan.

If, for any reason, you lose your employer group health plan coverage, you can get your Medigap policy back. You must notify your Medigap insurance company that you want your Medigap policy back within 90 days of losing your employer group health plan coverage.

Your Medigap benefits and premiums will start again on the day your employer group health plan coverage stops. The Medigap policy must have the same benefits and premiums it would have had if you had never suspended your coverage. Your Medigap insurance company can’t refuse to cover care for any pre-existing conditions you have. So, if you are disabled and working, you can enjoy the benefits of your employer’s insurance without giving up your Medigap policy.